The Chartered Accountant program is run by the (ICAI) Institute of Chartered Accountants of India according to set schedules. The student is advised to review this planned schedule for the CA course 2024 at the beginning of the academic year. Students can use the CA exam schedule for November/December 2024 to plan their studies.

Students can gain by eliminating pointless headaches and hiccups while registering for and submitting an examination application form. You will learn the crucial ICAI CA test dates and timetable for 2024 while reading this post.

The November 2024 Chartered Accountants’ Final Examination, which is governed by the syllabus authorized by the Council in accordance with Regulation 31(v) of the Chartered Accountants Regulations, 1988, represents a significant step for those pursuing a career as Chartered Accountants. It is essential for candidates to have a thorough understanding of the critical details, such as the exam timetable, qualification requirements, application steps, and significant dates. It is crucial that candidates carefully examine the course outline, familiarize themselves with the structure of the test, and follow the instructions given to guarantee a trouble-free and successful examination process. The effective preparation and awareness of the facts will help the applicants in navigating the examination process.

Check out the well-informed points for CA Final Examination November 2024 released by ICAI: https://resource.cdn.icai.org/81437exam65647g.pdf

The final exam dates for November 2024 have been announced by the Institute of Chartered Accountants of India (ICAI) for the upcoming Chartered Accountants Final Examinations. The students should complete their online application at the official website at eservices.icai.org once the application window opens.

The official schedules illustrate that the registration window for the November 2024 CA Final exam dates will open on August 7 and close on August 20. You can finish the process of registration on the official website at icai.org. For the November 2024 exam, those who are already registered can log in to their account and finish the application form.

Latest Update: A circular has been released by the Institute of Chartered Accountants of India (ICAI) describing the re-opening of online filing of examination forms for the Chartered Accountants Exams in November 2024. From September 11, 2024, to September 12, 2024, the students will be allowed to fill out the exam application forms with late fees of Rs 600.

Read the official announcement: https://www.icai.org/post/re-opening-exam-form-ca-nov2024

ICAI CA Final Exam Form Dates for November 2024

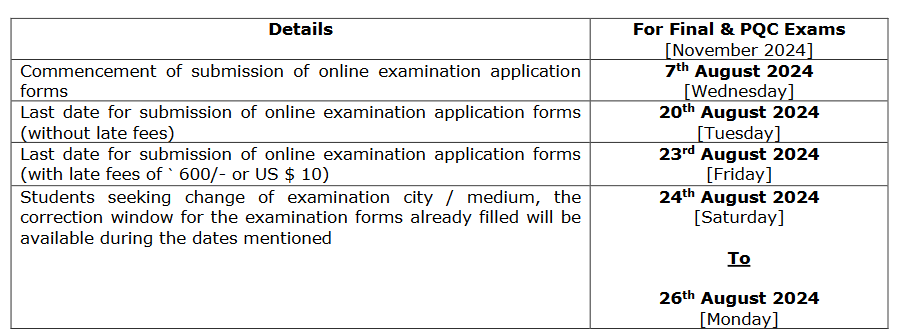

Here is a table that shows when the CA Final exam form must be submitted for the November 2024 exam.

| Exams Details | CA Final Exam Form Dates for November 2024 |

| Open the CA Final Exam form in Nov 2024 | 7th August 2024 |

| Last date of Final Exam Form Nov 2024 | 20th August 2024 |

| Last date of CA Final Exam Form (with late fees) | 23rd August 2024 |

| Open the Correction Window I | 24th August 2024 |

| Last Date of Correction Window I | 26th August 2024 |

| CA Final Admit Card Release Date | 15 Days Before the Exams |

| CA Final Exam Dates Nov 2024 | 1st Nov to 11th Nov 2024 |

| CA Final Exam Dates Group 01 | 1st and 3rd Nov and 5, 2024 |

| CA Final Exam Dates Group 02 | Nov 07, 09 and 11, 2024 |

Note: “Late fee is applicable from 21st August 2024 to 23rd August 2024”

Download Admit Card: There will be a link to admit cards on https://eservices.icai.org and a link to results on https://icai.org https://icai.nic.in

Opening and closing of the online window for submission of examination application forms and correction window.

The following dates(s) are suggested for consideration: –

No. 13-CA (EXAM)/NOVEMBER – DECEMBER/2024: The Institute of Chartered Accountants of India Council is pleased to announce that the upcoming Chartered Accountants Foundation, Intermediate, and Final Examinations will be held on the dates and locations listed below, provided that a sufficient number of candidates volunteer to appear from each of the below-mentioned places, under Regulation 22 of the Chartered Accountants Regulations, 1988.

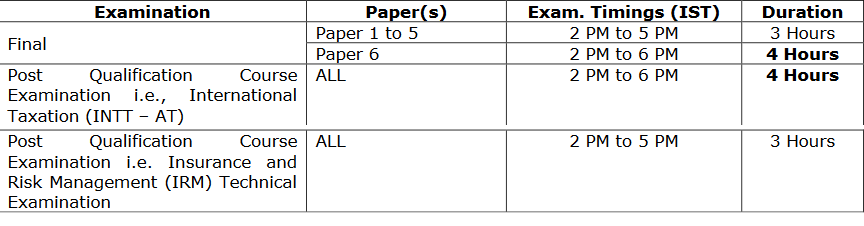

Likewise, the Examination in the Qualification Course under Regulation 204, viz.: i.e., International Taxation – Assessment Test (INTT – AT) and Insurance and Risk Management (IRM) Technical Examination (which is open to the members of the Institute) will be conducted on the dates and places (cities in India only) which are given below furnished that a satisfactory number of candidates propose themselves to appear from each of the below-mentioned places.

Step-by-Step Guide Online Filling Up of Examination Forms

You would be qualified for the CA Final Nov 2024 session if you have finished your CA Final registration 2024 and met all requirements. Below are the guide to apply-

- Step 1: Go to the ICAI’s official exam website or use the provided link.

- Step 2: Make your login with your registration number/login ID and password.

- Step 3: Login and find the “Apply now” option on the home page.

- Step 4: Fill out the CA Final 2024 exam form.

- Step 5: Analyse the information on the confirmation page.

- Step 6: Pay the exam form fee (Nov session) utilizing your preferred online method.

- Step 7: the system will automatically generate your ICAI CA Final 2024 exam application pdf form after successful payment.

- Step 8: Download and save the PDF receipt for future reference.

Documents Needed for CA Final Exam Form Nov 2024

Before completing the CA Final application form prepare the essential items-

- Ensure to have a signed CA Final registration form in PDF format.

- If applicable, keep your special category certificate ready for SC/ST, OBC, or differently-abled candidates.

- Furnish a scanned copy of your passport-sized photo and signature.

- Be prepared with the method for fee payment.

- Add a duly signed and scanned copy of the “Certificate of Service” in your documents.

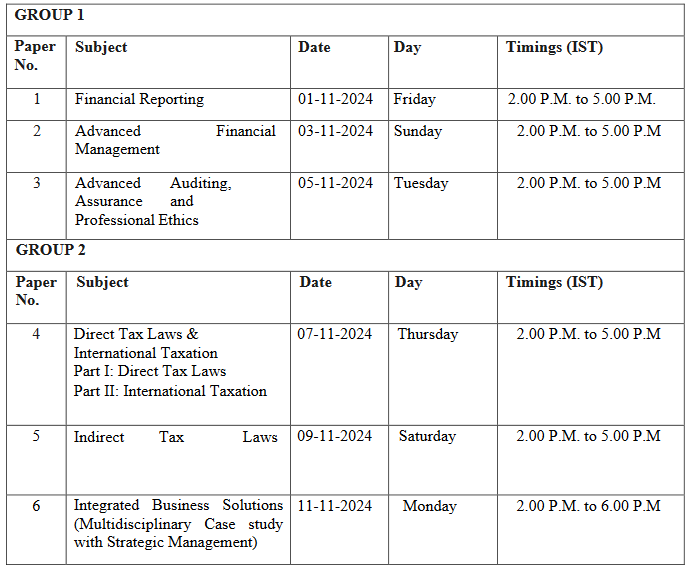

Dates and Timings of the Final Examination November 2024

Final Course Examination November 2024

“[As per syllabus contained in the scheme notified by the Council under Regulation 31 (iv) of the

Chartered Accountants Regulations, 1988.]”

| Group -I | 1st, 3rd & 5th November 2024 |

| Group -II | 7th, 9th & 11th November 2024 |

Members’ Examination November 2024

International Taxation – Assessment Test (INTT – AT)

| 9th & 11th November 2024 |

Insurance and Risk Management (IRM) Technical Examination November 2024

| Modules I to IV | 5th, 7th, 9th & 11th November 2024 |

“It may be emphasized that there would be no change in the examination schedule in the event of any

day of the examination schedule being declared a Public Holiday by the Central Government or any State

Government / Local Bodies.”

“Paper – 6 of the Final Examination and all papers of the International Taxation – Assessment Test are of 4 hours” duration.

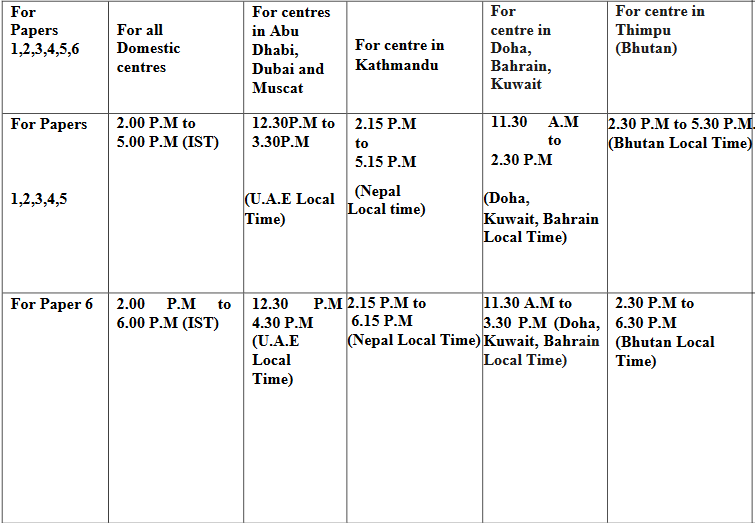

Examination Timings:

However, all other examinations are of 3 hours duration, and the examination-wise timing(s) are given below”

Information For Places of Examination Centres

if you want to have additional information on the places of examination centres, places of examination centres overseas, online exam forms, submission of examination application forms opening and closing of online window, exam fee, and answering options in Hindi then you can visit at: https://resource.cdn.icai.org/75028exam60567.pdf

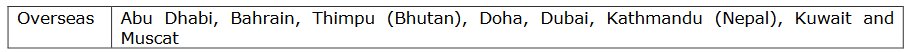

Places of Examination Cities [overseas]:

For Final Examination Only

The November 2024 examinations will be conducted at 8 (eight) overseas examination cities, namely:

The November 2024 Examinations will be conducted at 8 (Eight) overseas examination cities, namely:

The starting timing of the examination at Abu Dhabi, Dubai, and Muscat centres will be 12.30 PM i.e., Abu Dhabi, Dubai, and Muscat local time corresponding/equivalent to 2 PM. (IST). The starting time of the exam at Bahrain, Doha, and Kuwait Centre will be 11.30 AM i.e., Bahrain / Doha /Kuwait local time corresponding/equivalent to 2 PM (IST). 2.15 PM Nepal local time corresponding/equivalent to 2 PM (IST) will be the Examination beginning Timing at the Kathmandu (Nepal) Centre. The Examination beginning timing at Thimpu (Bhutan) Centre will be 2.30 PM Bhutan local time corresponding/equivalent to 2 PM (IST).

The ICAI reserves the right to withdraw any city/centre at any phase without giving any reason.

Kindly importance Note:

kindly open the following URL: https://eservices.icai.org/EForms/configuredHtml/1666/57499/Registration.html?action=existing if you have not enrolled as a user yet. Please use forgot password option if you have forgotten or lost your password. Students are asked to create a Username, Register for a Course, Convert the Course, Revalidate, and Update the Photo, Signature, and Address on SSP only.

Likewise, applications for admission to the Post Qualification Course Examination i.e. International Taxation –Assessment Test (INTT – AT) and Insurance and Risk Management (IRM) Technical Examination [which is open to the members of the Institute] are directed to apply online at pqc.icaiexam.icai.org and pay online the applicable examination fee.

By using a VISA or MASTER or MAESTRO Credit / Debit Card /Rupay Card / Net Banking / Bhim UPI, the examination fee can be remitted online.

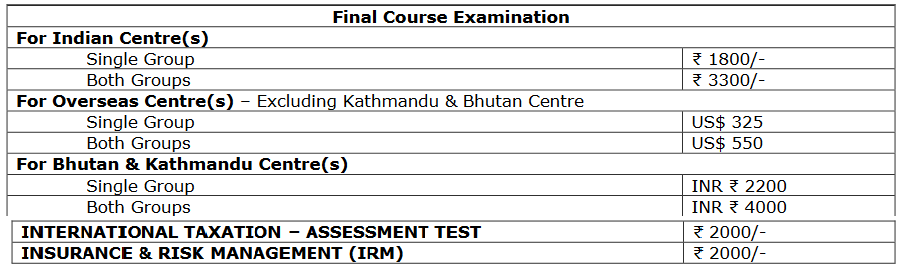

Examination Fee

The examination fee(s) for various courses are as under: —

Rs 600 is the late fee for submission of the examination application form after the scheduled last date (for Indian / Kathmandu / Bhutan Centres) and US $ 10 (for Abroad Centres) as determined by the Council.

OPTION TO ANSWER PAPERS IN HINDI:

The candidates of the final examination shall be permitted to choose the English / Hindi medium for answering papers. In the guidance notes the information will be found at https://eservices.icai.org But the exam medium will be only English concerning Post Qualification Course viz.: International Taxation – Assessment Test (INTT – AT) and Insurance and Risk Management (IRM) Technical Examination.

It is recommended that the candidates take note of the aforementioned and get in touch with the Institute’s website www.icai.org.

Read the Official announcement by ICAI: https://resource.cdn.icai.org/81144exam65340.pdf

Key Updates in the Guidance Notes for CA Final November 2024

ICAI Releases CA Final Nov 2024 Guidance Notes for Continuing the Exhausted Exemptions – Making Exemption/s Permanent

- Such candidates who had an exemption in the November 2022 examination which was valid till the May 2024 Exam, would have the option for continuing the said exemption after the declaration of the May 2024 Result.

- Exemption in any paper/s that has become exhausted on the declaration of the result of the immediately succeeding third exam will be displayed to the candidates according to the dates given in the Important Dates area at https://www.icai.org/post/exam-sep- nov-2024. (7th August 2024 to 26th August 2024)

- The Candidate who wants to make the exhausted exemption permanent will need to apply for the same via their dashboard of SSP.

- Candidates will get only ONE chance to make the exemption permanent ( i.e. exemption secured in November 2022 and getting exhausted after the conduct of the May 2024 exam will be displayed before the conduct of the November 2024 exam as per mentioned dates and if not made permanent by the candidate at the time of that period then that exemption will lapse forever)

- If a candidate has an exemption in two papers of the same group, for instance, papers 1 and 2 of Group-I that are proposed in this window, then, he/she needs to apply either for making both exemptions (i.e.; paper-1 & paper-2 in Group-1) permanent or let both the exemption lapse. He/she cannot choose to continue exemption in one paper and let it lapse in the other paper.

- The candidate upon making an exemption Permanent for any group will have to pass the pertinent group with at least 50% marks in each of the remaining papers of that group. Refer Regulation 38D(8) For Final.

- No Correction Window or Window with Late Fee after the inputs are taken.

- Candidates have the choice to surrender and re-appear in the exempted paper(s).

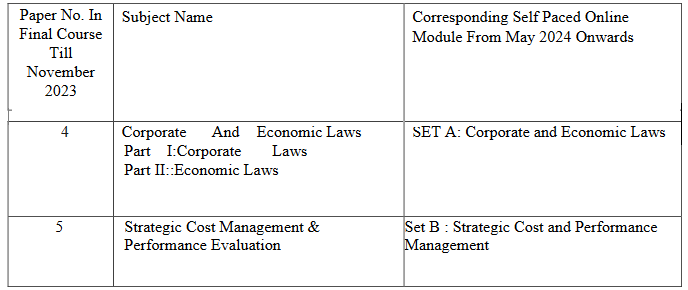

- Candidates reserving exemption in Paper-4 of Final in May 2022, Nov 2022, May 2023 or Nov 2023 exams will automatically get PERMANENT exemption from appearing in Self-Paced Module SET-A and need not apply.

- Candidates reserving exemption in Paper-5 of Final in May 2022, Nov 2022, May 2023 or Nov 2023 exams will automatically get PERMANENT exemption from appearing in Self-Paced Module SET-B and need not apply.

With effect from 1st July 2023, a New Scheme of Education and Training of the Institute of Chartered Accountants of India has been enforced. The examination at Intermediate and Final levels under the New Scheme of Education and Training will be held from the May 2024 Examination.

The Council of the Institute has determined to grant exemptions under the New Syllabus approved by it for the Intermediate Examination (under sub-regulation (4) of regulation 28G of the Chartered Accountants Regulations, 1988) and for Final Examination (under clause (v) of regulation 31 of the Chartered Accountants Regulations, 1988) to existing students for papers passed by them under the Old/Existing Scheme as follows: –

- If there is a Permanent Exemption (PE) in a group, no grant of new exemption will be in that group.

- If the candidate chooses to carry on the exemption post exhausting it, the exempted marks would be confined to 50 and excess marks of the permanent exempted paper could not be regarded to adhere with 50% aggregate marks needed of it or other Group.

Candidates are made familiar with the announcement on 24-08-2023 concerning exemption rules under the transition from the old to the new scheme. (Please read https://resource.cdn.icai.org/75658exam61200.pdf ) The pertinent mapping is provided hereunder for ready reference.